Guide to Financial Services Digital Transformation in 2026

In 2026, the pace of change in finance is relentless. Financial services digital transformation is no longer just a strategy, it is the foundation for growth and resilience. Are you prepared to modernize operations, delight customers, and outpace disruptors?

This guide is your roadmap. Discover what drives transformation, the tech reshaping finance, proven steps for implementation, and real-world examples. Learn how to future-proof your organization with actionable insights. Ready to lead your team to digital maturity and sustainable growth? Start here and chart your path forward.

The State of Digital Transformation in Financial Services (2026)

The financial services digital transformation landscape in 2026 is evolving rapidly, shaped by technology, regulation, competition, and workforce dynamics. Institutions are accelerating digital adoption to meet rising customer expectations, comply with new regulations, and stay ahead of industry disruptors.

Key Trends and Market Forces

In 2026, customer demand for seamless and personalized experiences is the primary driver behind financial services digital transformation. Consumers expect instant, intuitive interactions across all channels, pushing banks and insurers to reimagine service delivery. The competitive landscape is also shifting, as fintechs and big tech firms enter financial markets, challenging traditional players to innovate or risk losing market share.

Regulatory changes are increasing the need for transparency and compliance, while the shift to remote and hybrid work models since the pandemic has changed how financial institutions operate. According to EY, institutions with advanced digital adoption see 30 percent higher customer satisfaction rates. Digital-only banks and AI-powered investment platforms are growing rapidly, setting new standards for convenience and efficiency. The importance of ESG and sustainable finance is also rising, influencing both customer choices and regulatory mandates.

Financial services digital transformation is not just about technology, but also about adapting to these powerful market forces. For a deeper exploration of these trends and strategies, see Digital transformation strategies for 2026.

Technology and Innovation Drivers

Technology is at the heart of financial services digital transformation. Artificial intelligence, machine learning, and automation are now core tools for risk assessment, fraud detection, and delivering personalized customer experiences. Cloud computing has become the standard for scalable, secure, and cost-effective infrastructure, enabling organizations to launch new products quickly and adapt to changing demands.

Blockchain and digital assets are transforming payments, settlements, and identity verification. Open banking and API ecosystems are fostering collaboration between banks, fintechs, and third-party providers, creating opportunities for new business models. Over 70 percent of financial institutions have adopted AI-powered analytics, according to EY.

A key example is the use of generative AI for customer service chatbots and document processing, improving efficiency and accuracy. As financial services digital transformation advances, these innovations are becoming essential, not optional.

Regulatory and Security Landscape

The regulatory environment for financial services digital transformation is growing more complex, with evolving data privacy laws like GDPR and CCPA shaping digital initiatives. Institutions face heightened cybersecurity threats, requiring resilient digital architectures and constant vigilance.

There is also increased scrutiny on the ethical use of AI and responsible data handling. The World Bank, for instance, has adopted a “responsible use of AI” playbook to guide its digital innovation efforts. Staying compliant and secure is crucial for building trust and sustaining transformation.

Global regulators, including the Bank for International Settlements, emphasize secure and responsible innovation as a foundation for digital finance.

Workforce and Cultural Shifts

People remain at the core of successful financial services digital transformation. The demand for digital skills is rising, making continuous learning and upskilling essential across all levels of the organization. Effective change management is a critical success factor, as resistance to change can derail even the best technology investments.

EisnerAmper’s people-centric approach to ERP rollout, with tailored training and engagement, resulted in high adoption rates and project success. According to Prosci, organizations prioritizing change management report significantly higher success rates for digital initiatives. Building a culture of adaptability and innovation ensures that transformation efforts deliver lasting value.

According to McKinsey’s research on digital transformation in financial services, institutions that align technology with operating-model change outperform peers.

https://www.mckinsey.com/industries/financial-services/our-insights

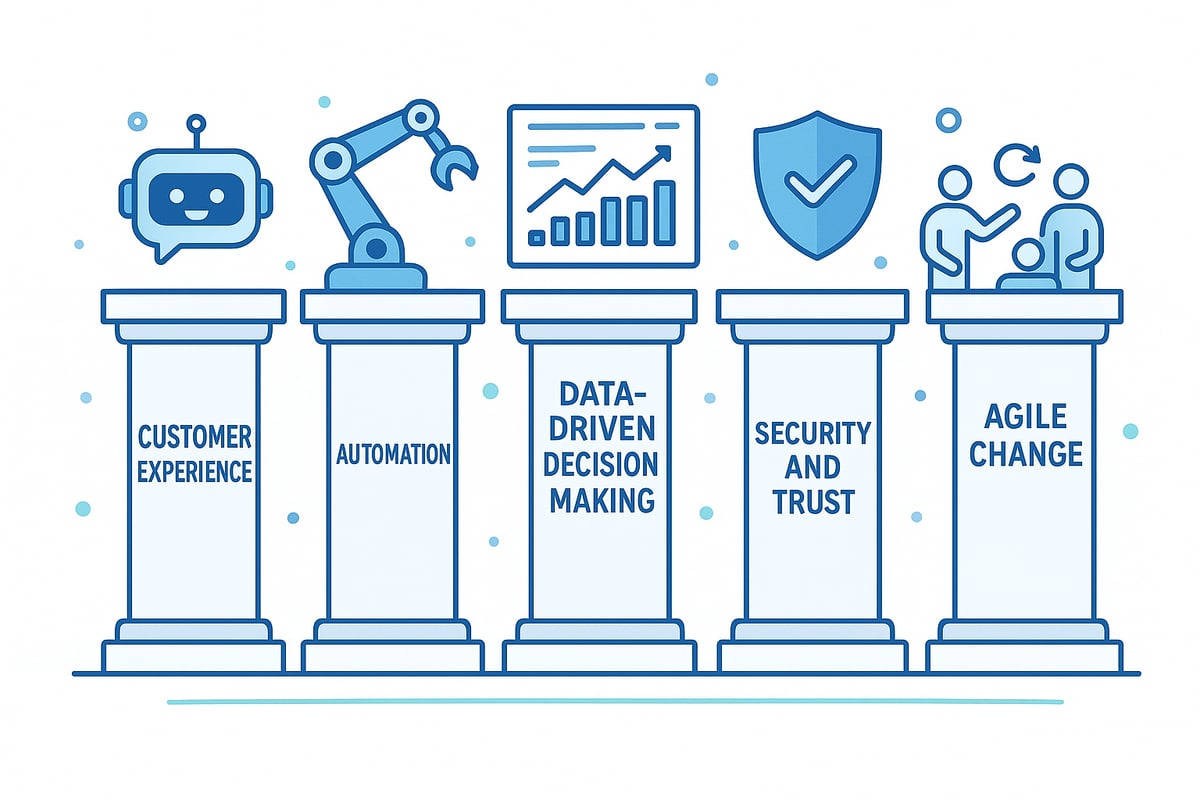

Pillars of Successful Financial Services Digital Transformation

Achieving success with financial services digital transformation requires a strategic focus on several foundational pillars. Each pillar supports the next, creating a framework that ensures technology investments deliver measurable value, resilience, and customer loyalty. Let’s break down these essential building blocks, highlighting how leading institutions are putting them into practice.

Customer-Centric Digital Experiences

At the heart of financial services digital transformation is delivering exceptional customer experiences. Institutions leverage AI and data analytics to personalize offerings, predict needs, and engage clients across mobile, online, and in-branch channels.

Modern banks offer seamless self-service tools, allowing customers to manage accounts, payments, or investments 24/7. AI-powered chatbots resolve routine queries, freeing up human agents for complex issues. This omnichannel approach creates a unified journey, increasing satisfaction and loyalty.

Institutions with strong digital experiences report 25 percent higher customer retention. By focusing on customer needs, financial services digital transformation drives growth and builds lasting relationships.

Operational Efficiency and Automation

Financial services digital transformation unlocks new levels of operational efficiency. Robotic Process Automation streamlines repetitive back-office tasks, while intelligent document processing accelerates compliance and onboarding.

Institutions use real-time analytics for faster decision-making and improved service delivery. Automation in processes like loan approvals can cut turnaround times by half, enhancing both speed and accuracy.

To learn more about these trends, see AI and automation in financial services. In 2026, 60 percent of banks plan to increase automation investments, making efficiency a competitive differentiator.

Data-Driven Decision Making

Harnessing data is central to financial services digital transformation. Financial institutions rely on big data and predictive analytics to manage risk, develop products, and provide tailored advice.

Enhanced reporting and real-time dashboards support regulatory compliance and offer executives deep insights. AI-driven credit scoring improves underwriting, reducing risk and expanding access to financial products.

With 80 percent of financial leaders prioritizing data analytics, organizations that invest in these capabilities lead the way in innovation and performance.

Security, Compliance, and Trust

Trust is the cornerstone of financial services digital transformation. As digital adoption grows, so do cybersecurity threats and regulatory demands.

Organizations build resilient security frameworks, integrating compliance into digital workflows from the outset. Transparent data governance ensures customers control their information, while gamified cyber training reduces errors and strengthens defenses.

Regulatory fines for data breaches have increased by 20 percent since 2024, highlighting the need for proactive security and compliance strategies.

Agile Delivery and Change Management

Agile works in financial services when it’s used to solve real problems, not just to ship faster. Breaking transformation into smaller, testable increments allows teams to learn quickly, course-correct early, and show progress without betting everything on a single rollout.

But speed alone doesn’t drive adoption. Change management is what makes new ways of working stick. That means leaders staying visibly aligned, communication that’s practical and consistent, and trusted people inside the organization acting as change champions. EisnerAmper’s multi-channel training approach is a good example of how this plays out in practice.

When change is managed deliberately, teams engage sooner, resistance drops, and initiatives move from “launched” to actually used. It’s why transformations backed by strong change management are far more likely to succeed and continue delivering value over time.

Step-by-Step Guide to Digital Transformation in Financial Services (2026)

Embarking on a successful financial services digital transformation journey in 2026 requires a structured, strategic approach. Below, you’ll find a practical, step-by-step framework designed to help leaders move from vision to value, ensuring every aspect of transformation is addressed. Each step builds momentum, keeps teams aligned, and positions your organization for long-term success.

Step 1: Define Vision and Strategy

Start your financial services digital transformation by setting a clear vision anchored in business goals and evolving customer needs. Secure executive sponsorship early, as leadership buy-in is critical for momentum and support. Define measurable KPIs to track progress and success.

For example, many banks articulate a vision of “frictionless digital banking” across all channels, aligning every initiative with this north star. Without a shared strategy, efforts become fragmented and risk stalling. According to industry data, 70% of failed transformations lack a clear vision and leadership alignment.

A strong foundation ensures every team member understands the purpose and desired outcomes of financial services digital transformation.

Step 2: Assess Current State and Readiness

Before launching any new initiative, conduct a thorough digital maturity assessment. Evaluate your technology stack, data quality, processes, and workforce capabilities. Identifying gaps and strengths helps shape your transformation roadmap.

Consider regulatory and compliance requirements specific to your markets. The World Bank, for instance, uses comprehensive readiness reviews before deploying new digital tools. Yet, only 40% of financial institutions conduct such assessments, according to EY.

A realistic view of your organization’s readiness reduces risk, keeps projects on track, and maximizes the impact of financial services digital transformation.

Step 3: Build a Future-Ready Digital Architecture

Modernize your infrastructure by prioritizing cloud adoption, enabling scalability and resilience. Integrate AI, automation, and analytics into core systems for smarter, faster operations. Adopting open APIs helps you connect with fintech partners and build new business models.

Migrating legacy systems to cloud-native platforms is a common first step. In 2026, 80% of new financial products are built on cloud infrastructure. For a deeper dive on AI’s role in this journey, explore 7 ways AI will shape 2026 finance.

A robust architecture underpins every successful financial services digital transformation, supporting innovation and agility.

Step 4: Embed Security and Compliance from Day One

Security and compliance must be woven into every digital initiative. Establish robust cybersecurity protocols, monitor systems continuously, and automate compliance workflows to reduce manual errors. Develop frameworks for ethical AI and responsible data use to build trust.

For example, the World Bank requires annual cyber training for all employees, ensuring staff can identify threats and act quickly. With cybersecurity spending in financial services projected to reach $60B by 2026, this area cannot be overlooked.

Embedding compliance and security from the outset protects your financial services digital transformation from costly disruptions.

Step 5: Prioritize Customer Experience and Engagement

Map digital customer journeys to identify pain points and opportunities for innovation. Deploy AI-powered personalization and self-service solutions, such as chatbots and instant KYC verification, to enhance engagement and satisfaction.

Feedback loops are essential for continuous improvement. Data shows 65% of customers now prefer digital onboarding over in-branch processes. By focusing on seamless experiences, you can boost retention and attract new customers.

Elevating customer experience is central to every high-impact financial services digital transformation.

Step 6: Empower People and Drive Change

People are the heart of transformation. Invest in digital skills training at all levels and promote a culture of continuous learning. Use structured change management methodologies, such as Prosci ADKAR, to guide employees through transitions.

EisnerAmper’s internal campaigns and role-specific training are great examples of building change capability. Companies with strong change management deliver projects 30% faster and see higher adoption rates.

Prioritizing people ensures your financial services digital transformation is embraced, not resisted.

Step 7: Deliver in Agile, Iterative Cycles

Break your transformation into manageable phases, focusing on quick wins that build confidence. Use agile teams to prototype, test, and refine solutions rapidly. Monitor progress with real-time dashboards and adjust based on outcomes.

The World Bank’s adoption of agile methodologies has enabled faster delivery and greater flexibility. Data shows agile projects deliver a 50% higher ROI compared to traditional approaches.

Agile practices keep your financial services digital transformation adaptable, responsive, and continuously improving.

Step 8: Scale, Optimize, and Future-Proof

Once initial pilots succeed, scale them organization-wide. Use analytics and automation to optimize processes and drive ongoing efficiency. Plan for emerging technologies and shifting customer expectations to stay ahead of the curve.

Building a Change Management Center of Excellence, as EisnerAmper did, helps sustain transformation momentum. With 90% of leaders viewing continuous optimization as critical, future-proofing is a must.

Scaling and optimizing ensures your financial services digital transformation delivers long-lasting value and resilience.

Real-World Case Studies and Lessons Learned

Unlocking the true potential of financial services digital transformation requires learning from organizations that have navigated the journey. Below, we explore real-world case studies that illustrate how people, process, and technology combine for lasting impact.

EisnerAmper: People-Centric ERP Transformation

EisnerAmper faced a classic challenge in their financial services digital transformation: outdated legacy systems were slowing growth and making acquisitions difficult. To address this, they launched an ambitious enterprise-wide ERP rollout, putting people at the heart of every decision.

Their approach was grounded in structured change management, leveraging the Prosci methodology. EisnerAmper engaged employees early and often, hosting interactive roadshows, delivering role-specific communications, and offering multi-channel learning opportunities. Gamified training helped increase engagement and build digital fluency across teams.

The results were impressive. The ERP rollout was completed on time, adoption rates exceeded expectations, and a Change Management Center of Excellence was created to sustain transformation efforts. This case demonstrates that involving people from the start, listening to their needs, and providing tailored training are essential ingredients for success.

For more real-world stories highlighting the people side of transformation, explore case studies of transformation success.

World Bank: Accelerating Secure Digital Adoption

The World Bank needed to accelerate its financial services digital transformation while ensuring robust security and compliance. Facing the dual demands of global operations and heightened cyber threats, the organization prioritized agility and continuous learning.

The World Bank’s strategy included adopting agile delivery approaches, mandating annual cyber training for all employees, and establishing an internal AI framework with clear ethical guidelines. Gamified learning modules engaged over 30,000 staff worldwide, while a “responsible use of AI” playbook guided teams through the complexities of digital innovation.

Key outcomes included a significant reduction in cyber-related errors, stronger digital capabilities, and scalable innovation that could be replicated across departments. The World Bank’s journey shows that building a culture of security and continuous improvement is just as critical as adopting new technology in financial services digital transformation.

Additional Industry Examples

Across the industry, financial services digital transformation is driving innovation and operational efficiency. Digital-only banks are using AI to provide 24/7 customer support and deliver personalized financial advice tailored to each user’s profile.

Insurers have embraced automation for faster claims processing and proactive fraud detection, reducing turnaround times and operational costs. Wealth management firms are leveraging data analytics to create bespoke investment strategies for their clients, improving both satisfaction and retention.

According to EY, 75% of financial institutions now cite customer-centric innovation as a top driver for transformation. The lesson is clear: successful financial services digital transformation blends technology adoption with a relentless focus on people and process improvement.

Building Long-Term Digital Maturity and Resilience

Staying ahead in financial services digital transformation requires a future-focused mindset. Organizations must continually adapt, innovate, and build resilience to thrive in 2026 and beyond. The journey is ongoing, demanding attention to technology, people, measurement, and overcoming obstacles.

Continuous Innovation and Emerging Technology Adoption

Continuous innovation is at the heart of financial services digital transformation. Organizations must keep an eye on new technologies like quantum computing and decentralized finance, preparing to pilot and integrate them as they mature.

Building flexible, modular architectures makes it easier to adapt to change. Early adoption of generative AI, especially for compliance and customer interactions, is already delivering benefits. According to industry reports, 60% of leaders plan to invest in emerging tech by 2027, a trend explored in Top 5 Technology Trends Shaping Banking & Financial Services in 2026.

Staying innovative means not just following trends, but actively experimenting and learning from pilots. This approach ensures your financial services digital transformation remains relevant as the landscape evolves.

Talent, Culture, and Leadership Development

People are the engine of financial services digital transformation. Attracting digital talent is crucial, but so is developing leadership that understands technology and can guide teams through change.

Organizations that foster a culture of experimentation and psychological safety see greater innovation and growth. For example, nominating AI champions helps drive adoption and spreads digital fluency across departments.

A strong digital culture sets top performers apart. Data shows companies with this focus outperform their peers by two times in growth. Prioritizing talent and leadership ensures your financial services digital transformation is sustainable and impactful.

Measuring Success and Ensuring ROI

Measuring the impact of financial services digital transformation is essential for long-term success. Defining clear KPIs, such as customer satisfaction and cost savings, provides direction and accountability.

Real-time analytics help monitor progress and highlight areas for improvement. Leading firms, like EisnerAmper, track metrics such as logins and invoices to measure adoption and value.

Outcome-based measurement, used by 80% of digital leaders, ensures that transformation efforts deliver real business results. Regularly reviewing these metrics keeps your strategy aligned with organizational goals.

Overcoming Common Challenges

Financial services digital transformation comes with hurdles. Integrating legacy systems and managing technical debt can slow progress. Change fatigue and resistance often threaten project momentum.

Regulatory uncertainty adds another layer of complexity. Employing structured change management frameworks, like Prosci, helps reduce project derailments and maintain focus.

Here is a quick summary of common challenges and solutions:

Addressing these challenges head-on ensures your financial services digital transformation stays on track and delivers value.

How Lithe Transformation Accelerates Financial Services Digital Transformation

Lithe Transformation is a trusted partner for financial services digital transformation. The company helps banks, insurers, and financial organizations achieve digital, agile, and AI-driven change from strategy through execution.

Their services span agile at scale, AI engineering, and organizational redesign tailored to regulated industries. With a proven record of accelerated delivery and sustainable results, Lithe blends strategy, technology, and hands-on support.

Major banks and financial institutions across Europe and the Middle East trust Lithe for measurable business outcomes. For a consultation or to learn more, visit thinklithe.com.

Digital transformation in financial services isn’t a tech rollout. It’s a business shift. It’s about making smarter decisions, equipping your teams to move faster, and building systems that hold up as your market, customers, and regulations evolve.

If you’re at a point where customer experience needs a rethink, AI feels promising but unclear, or agile ways of working haven’t quite stuck, this is where we come in. We work alongside leadership teams to turn strategy into execution and ensure change delivers real, measurable impact.

If you want an honest conversation about where you are today and what needs to change to move forward, let’s talk. Get in touch and we’ll take it from there.